عنا

مرحبا هل يمكنني مساعدتك؟

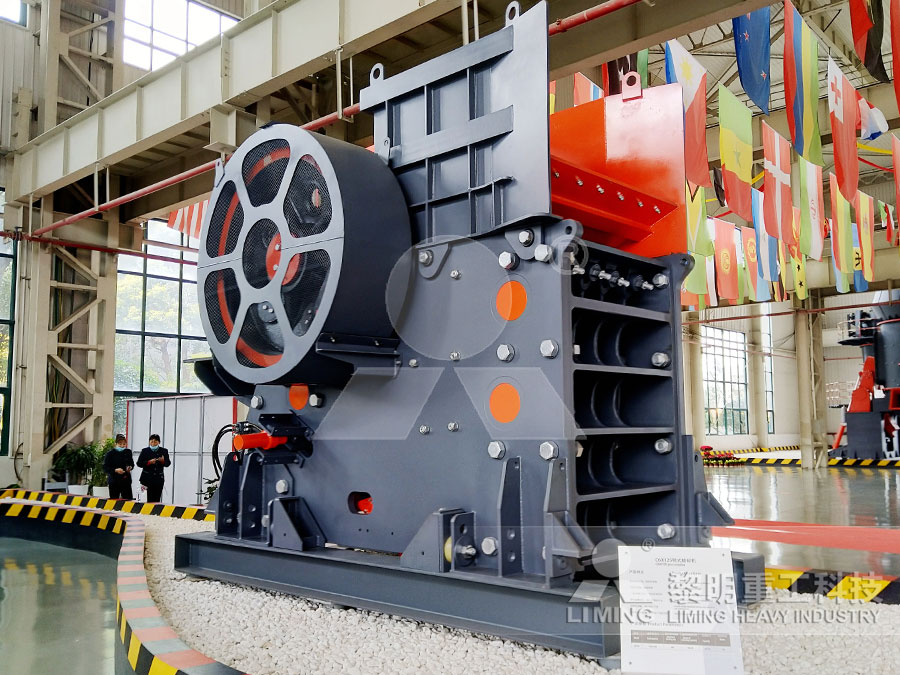

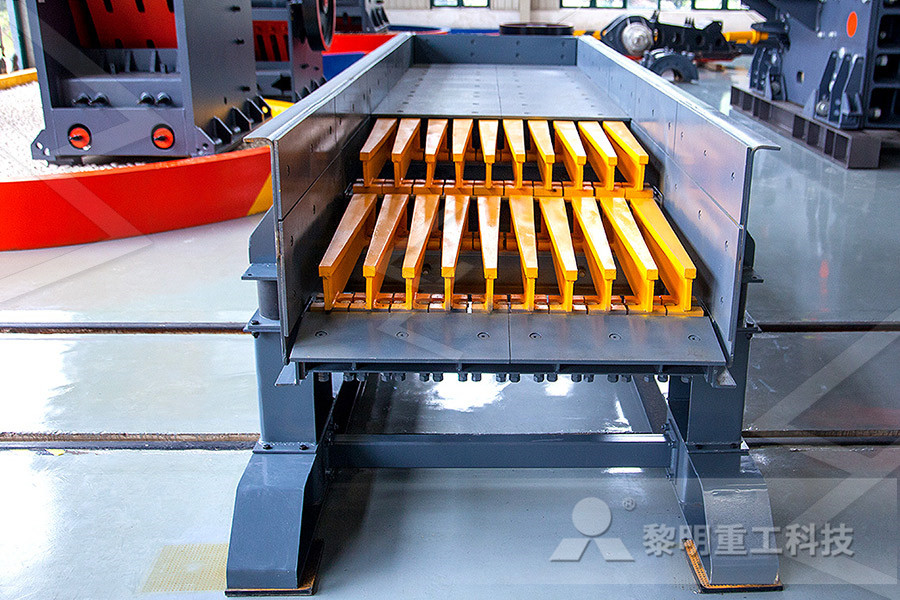

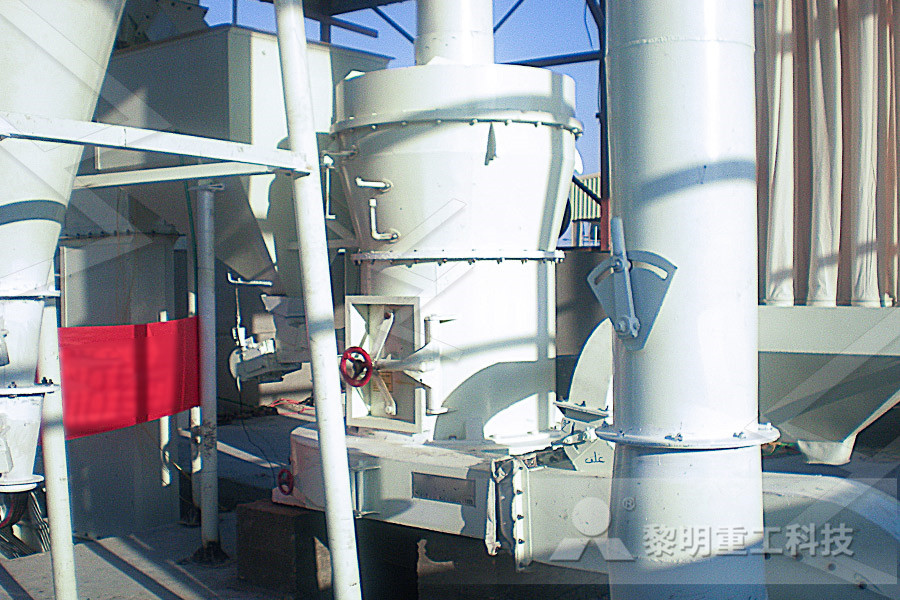

تأسست شركة Liming Heavy Industry في عام 1987 ، وتقع في منطقة Pudong الجديدة ، شنغهاي ، الصين ، وتغطي أكثر من 200000 متر مربع بما في ذلك العديد من الشركات التابعة. يتعلق العمل الرئيسي بالعديد من المجالات ، مثل تكسير المناجم ، وسحق المباني ، والطحن ، وصنع الرمل ، والتكسير المتنقل ، وما إلى ذلك. الكسارة ، الكسارة المخروطية الهيدروليكية عالية الكفاءة من سلسلة HPT ، المطحنة الأوروبية شبه المنحرفة MTW ، المطحنة العمودية LM ، المطحنة الأسطوانية العمودية فائقة الدقة من سلسلة LUM ، الكسارة الصدمية ذات المحور الرأسي VSI5X ، ومعدات نظام VU.

يجلب Liming عددًا كبيرًا من المواهب الذكية والإبداعية معًا الذين يقدمون منتجات مبتكرة باستمرار. أخذت الشركة زمام المبادرة في الحصول على شهادة نظام الجودة الدولية ISO9001: 200 ، وشهادة الاتحاد الأوروبي CE وشهادة GOST الروسية ، وقد حصلت على 106 براءة اختراع وطنية بما في ذلك 4 براءات اختراع ، و 12 براءة اختراع تصميم و 90 براءة اختراع لنماذج المنفعة حتى الآن. إلى جانب ذلك ، هناك العديد من الجوائز مثل جوائز العلوم والتكنولوجيا في صناعة الآلات الصينية ، وجوائز الإنجاز العلمي والتكنولوجي في المقاطعات ، والمنتجات الصناعية الموفرة للطاقة في قائمة شرف ليمينغ.

من أول جهاز خروج تم تركيبه وتصحيحه بنجاح في كازاخستان إلى أول خط ذكي لتصنيع الرمل يعمل بسلاسة في المملكة العربية السعودية ، قدمت Liming خدماتها لـ 140 دولة ومنطقة ، مثل روسيا وكازاخستان وأذربيجان وتركيا والكويت وجنوب إفريقيا ومصر ، لا يمكن تجاهل فيتنام وماليزيا والهند وأستراليا وكوريا وكندا والاتحاد الأوروبي ، وما إلى ذلك ، وقوة الشركة في آلات التعدين العالمية بعد الآن.

رسالة عبر الإنترنت

مرحبا هل يمكنني مساعدتك؟

ratio analysis mining industry average

2020-07-25T09:07:47+00:00

Metal Mining: industry financial ratios benchmarking

22 rows Metal Mining: average industry financial ratios for US listed companies Industry: 10 22 rows Average industry financial ratios for 'Mining' industry sector ReadyRatios financial Mining: industry financial ratios benchmarkingQuick Ratio Comment On the trailing twelve months basis Metal Mining Industry's Cash cash equivalent grew by 3511 % in the 4 Q 2020 sequentially, faster than Current Liabilities, this led to improvement in Metal Mining Industry's Quick Ratio to 11 in the 4 Q 2020,, above Metal Mining Industry average Quick RatioMetal Mining Industry financial strength, leverage

2021 Mining Industry Statistics Market Research Report

Financial ratio information can be used to benchmark how a Mining company compares to its peers Accounting statistics are calculated from the industryaverage for income statements and balance sheets Compensation Salary Surveys for EmployeesMetal Mining Industry Price to Earning ratio is at 6628 in the 4 Quarter 2020 for Metal Mining Industry, Price to Sales ratio is at 469, Price to Cash flow ratio is at 1195, and Price to Book ratio is 353 More on Metal Mining Industry ValuationMetal Mining Industry Valuation, Price to Earnings PE The EV/EBITDA NTM ratio of BHP Group Ltd is significantly higher than the average of its sector (General Mining): 486 According to these financial ratios BHP Group Ltd's valuation is way above the market valuation of its sector The EV/EBITDA NTM ratio of BHP Group Ltd is higher than its historical 5year average: 65BHP Group Ltd: Financial ratios (BHP AUS General

Coal Mining: industry financial ratios benchmarking

Coal Mining: average industry financial ratios for US listed companies Industry: 12 Coal Mining Measure of center: median (recommended) average Financial ratioMining in the US industry outlook (20212026) poll Average industry growth 20212026: xx lock Purchase this report or a membership to unlock the average company profit margin for this industryMining in the US Industry Data, Trends, Stats IBISWorldMarket Size Industry Statistics The total US industry market size for Mining: Industry statistics cover all companies in the United States, both public and private, ranging in size from small businesses to market leadersIn addition to revenue, the industry market analysis shows information on employees, companies, and average firm size2021 Mining Industry Statistics Market Research Report

Financial analysis of the US mineral and mining industry

Jun 01, 1993 The purpose of this study is not to predict, ance of the mining and mineral industry have used ratio analysis or but to inform, particularly in the ap simply a discussion of its sources of finance z In this study, the financial plications of a few financial analytical performance of the mining industry for the past 20 years is analysed Aug 20, 2010 Save Save Ratio Analysis Mining Industries For Later 0% 0% found this document useful, Mark this document as useful 0% 0% found this document not useful, Mark this document as not useful Embed Share Print Download now Jump to Page Ratio Analysis Mining Industries ScribdReceivable Turnover Ratio Comment: Construction Mining Machinery Industry 's Receivable turnover ratio sequentially increased to 278 in the 4 Q 2020, below Construction Mining Machinery Industry average Within Capital Goods sector 4 other industries have achieved higher receivable turnover ratioConstruction Mining Machinery Industry Efficiency

Metal Mining Industry Valuation, Price to Earnings PE

Metal Mining Industry Price to Earning ratio is at 6628 in the 4 Quarter 2020 for Metal Mining Industry, Price to Sales ratio is at 469, Price to Cash flow ratio is at 1195, and Price to Book ratio is 353 More on Metal Mining Industry ValuationThe metals mining industry includes 1) Aluminum: companies that produce, refine, market, and distribute aluminum and related aluminumbased products 2) Copper: companies engaged in the exploration, mining, smelting, and refining of copper ores and related copper productsMetals Mining Industry GuruFocusFigure 1: Comparison of the profit margin ratio for the quarters ended March 2013 and June 2013 SIC 2 – Mining and quarrying industry SIC 3 – Manufacturing industry SIC 4 – Electricity, gas and water supply industry SIC 5 – Construction industry SIC 6 – Trade industry SIC 7 – Transport, storage and communication industryQuarterly Financial Statistics: Ratio Analysis

Financial Ratios Complete List and Guide to All

Comparing financial ratios with that of major competitors is done to identify whether a company is performing better or worse than the industry average For example, comparing the return on assets between companies helps an analyst or investor to determine which company is making the most efficient use of its assetsJun 16, 2020 The average net profit margin of the world’s top 40 mining companies stood at some seven percent in 2014, but decreased to negative seven Top mining companies net profit margin 2019 StatistaIndustry Name: Number of firms: Current PE: Trailing PE: Forward PE: Aggregate Mkt Cap/ Net Income (all firms) Aggregate Mkt Cap/ Trailing Net Income (only money making firms) Expected growth next 5 years: PEG Ratio: Advertising: 61: 2095: 4538: 3892: 3155Price Earnings Ratios New York University

Financial analysis of the US mineral and mining industry

Jun 01, 1993 The purpose of this study is not to predict, ance of the mining and mineral industry have used ratio analysis or but to inform, particularly in the ap simply a discussion of its sources of finance z In this study, the financial plications of a few financial analytical performance of the mining industry for the past 20 years is analysed Coal Mining Industry Gross Profit grew by 589 % in 4 Q 2020 sequntially, while Revenue increased by 219 %, this led to improvement in Coal Mining Industry's Gross Margin to 3255 %, Gross Margin remained below Coal Mining Industry average On the trailing twelve months basis gross margin in 4 Q 2020 fell to 3539 %Coal Mining Industry Profitability by quarter, Gross Jun 16, 2020 The average net profit margin of the world’s top 40 mining companies stood at some seven percent in 2014, but decreased to negative seven Top mining companies net profit margin 2019 Statista

Ratio Analysis Mining Industries Scribd

Aug 20, 2010 Save Save Ratio Analysis Mining Industries For Later 0% 0% found this document useful, Mark this document as useful 0% 0% found this document not useful, Mark this document as not useful Embed Share Print Download now Jump to Page Feb 23, 2021 Industry ratios are an aggregate measure of industry performance Publishers gather data from the financial statements of hundreds of firms to calculate industry averages Often they break out the results into categories based on the asset size of the companiesFinding Industry Ratios Ratio Analysis Research Guides Figure 1: Comparison of the profit margin ratio for the quarters ended March 2013 and June 2013 SIC 2 – Mining and quarrying industry SIC 3 – Manufacturing industry SIC 4 – Electricity, gas and water supply industry SIC 5 – Construction industry SIC 6 – Trade industry SIC 7 – Transport, storage and communication industryQuarterly Financial Statistics: Ratio Analysis

Your financial ratios: Where to find industry BDCca

Dun Bradstreet’s Key Business Ratios on the Web provides online access to benchmarking data It provides 14 key business ratios including solvency ratios, efficiency ratios and profitability ratios for over 800 types of businesses arranged by industry categories Wolters Kluwer publishes the Almanac of Business and Industrial Financial Industry Name: Number of firms: Current PE: Trailing PE: Forward PE: Aggregate Mkt Cap/ Net Income (all firms) Aggregate Mkt Cap/ Trailing Net Income (only money making firms) Expected growth next 5 years: PEG Ratio: Advertising: 61: 2095: 4538: 3892: 3155Price Earnings Ratios New York UniversityIndustry market research reports, statistics, analysis, data, trends and forecasts This website uses cookies to improve your user experience while you navigate through the website We also use thirdparty cookies that help us analyze and understand how you use this websiteIndustry Financial Ratios IBISWorld

Mining industry in Australia statistics facts Statista

Dec 17, 2020 Discover all statistics and data on Mining industry in Australia now on statista! Try our corporate solution for free! (212) 4198286 Customized Research Analysis projects:The best way to value a mining asset or company is to build a discounted cash flow (DCF) model that takes into account a mining plan produced in a technical report (like a Feasibility Study) Without such a study available, one has to resort to more crude metrics Here is an overview of the main valuation methods used in the industry:Mining Valuation Techniques P/NAV, P/CF, EV/ResourceNov 20, 2019 The price to cash flow ratio is an appraisal of a company's share price to its cash flow This ratio is generally accepted as being more reliable than the price per earnings ratio, as it is harder for false internal adjustments to be made To calculate the price to cash flow ratio, use this formula: Share Price ÷ Operating Cash Flow per ShareCash Flow Ratios for Analysis

Industry Financial Ratios Industry Information Library

Oct 14, 2020 Only the industry average is presented, but each line of business has more companies represented than the RMA Companies making a profit that year are presented in a separate table Industry Norms and Key Business Ratios Financial and operating ratios for 800 lines of business Balance sheet and income statement information and 14 financial Industry Norms and Key Business Ratios Industry Norms and Key Business Ratios The following key business ratios were obtained from the public domain and may not be accurate However, they will give you a rough idea Key Business Ratios can be obtained Industry Norms and Key Business Ratios Credit Guru Inc